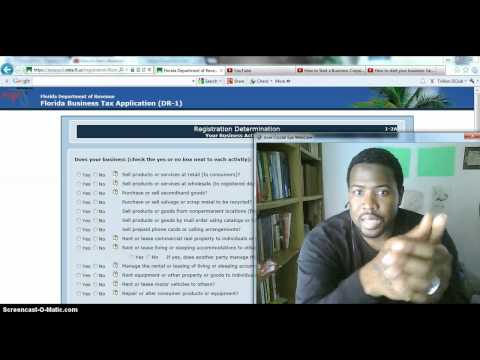

Divide this text into sentences and correct mistakes: 1. What up, what up, yo, it's your boy Xpress playing your destiny dot-com and so on. 2. Where we left off on the last video was getting a reseller certificate, aka a wholesale license. 3. This would be good for you if, like I said, you sell things in quantities, sell it in bulk, and want to get discounts on things like that. 4. But my words of caution are that when you get this sales and use tax certificate, it's important and imperative that you go through these steps correctly. 5. Okay, and that's probably the only reason this whole video has to do with this because it's important. 6. So, this is what we're gonna do. 7. Okay, you're going to lose me once you go to the do-re-mi florida dot-com, or depending on your state, you want to look for the Department of Revenue in your state. 8. So, if you're in California, look at the California Department of Revenue. 9. Okay, and it should take you to a website that is kind of similar to this. 10. Again, this is the Florida Department of Revenue, but the process is pretty similar in all other states. 11. What you want to do is the first thing we did is when we got to the website, we went to businesses and employers, and it took us here. 12. Now, what you want to do is you want to click on sales and use tax. 13. Okay, it's going to take you to this page. 14. Now, this page is going to outline who must pay tax registration, filing, and paying taxes. 15. This is what I want you to look at because it's important. 16. This filing frequency limits, so if you're making more than a thousand dollars, you must...

Award-winning PDF software

St-13 ma Form: What You Should Know

For Tax Day — September 30, 2025 | Fill your tax forms and check your status online before you mail or drop them off to the county tax collector — or mail them to your tax collector for you. Check your taxes today! — Tax Day, 2025 | Fill your State and local taxes today with today's Tax Day 2025 check-off events. Small Business Energy Exemption | Local gov.ca Jan 31, 2025 — To qualify for small business and energy tax exemptions, the qualifying business must be engaged in any trade or profession in Mass. and use a renewable energy resource as its principal source of power. Small Business Energy Exemption | Mass.gov Mar 31, 2025 — A small business in possession of a certificate in an energy industry and the owner or owner's spouse is the primary consumer is eligible for a 10% energy credit on energy used in a home, for the purposes of calculating the qualified business energy use. Small Business Energy Exemption | The Mass Business Administration | Small Business and Family Law Division Mar 31, 2022— A small business can request up to 2/12 of an exemption certificate (with a maximum of 3/12 total) for a small business energy program. Mar 18, 2020— An individual or organization may provide proof that they have a small business energy program in order to obtain an exemption certificate. Online Certificate or Filing a Paper Certificate? — Get ready for the future and know you're in the right place. Fallout a Certificate, Download Small Business Energy Exemption — (ST-13) — Department of Revenue (Mass.) form. Form ST-13 — Fill Online, Printable, Fillable, Blank | filler Fill Form ST-13, Use in-person (online) at the Taxpayer Services Center or fax it to the TDM (Mass.). Try Now! For Tax Day — August 31, 2025 | Fill your tax forms and check your status online before you mail or drop them off to the county tax collector — or mail them to your tax collector for you. Check your taxes today! — Tax Day, 2025 | Fill your State and local taxes today with today's Tax Day 2025 check-off events. Small Business Energy Exemption | Local gov.ca Jan 31, 2025 — To qualify for small business and energy tax exemptions, the qualifying business must be engaged in any trade or profession in Mass.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ma DoR ST-4, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ma DoR ST-4 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ma DoR ST-4 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ma DoR ST-4 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing St-13 form ma