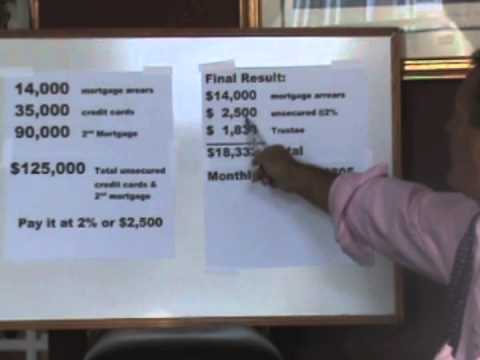

I've put together an example of a chapter 13 plan. Sometimes, it's easy to visualize it in this particular case. Actually, it's kind of a typical example of a family in a chapter 13 situation. Here, we have this particular family with $14,000 in mortgage arrears. The bank wanted to foreclose on their house based on the fact that they are $14,000 behind. They wanted either the lump sum or a reduction. The family had $35,000 on their credit cards and a second mortgage of $90,000. So, how do we treat that in this particular example? We'll total it up to $125,000 in total unsecured debt, which includes their credit cards and the second mortgage. In this case, we'll pay that through the plan at 2% of the total, $125,000. This is based on income and other circumstances, but in this case, it would be 2% or $2,500. So, basically, this is what they would pay back over five years - $2,500 with no interest or penalties. Now, the second mortgage is included as an unsecured debt because the house is underwater. In other words, the house is not worth more than the first mortgage, so the second mortgage of $90,000 becomes unsecured. We treat it the same way we treated the credit card debt. So, this becomes a big moment, almost $1,000 a month for these people to pay every month. And because, again, the house isn't worth more than the first mortgage, the second mortgage becomes unsecured like the credit cards, totaling $125,000, which then becomes $2,500. In the final results, we take the $14,000 in secured mortgage arrears, which we can't eliminate, but we can pay back without interest, penalties, and late fees. They can't foreclose on these folks. So, we take $14,000 plus the $2,500, and there's a...

Award-winning PDF software

St 13 ma Form: What You Should Know

Mar 24 — The Department of Revenue provides the required paper forms for a small business energy exemption when they have not yet issued an Energy Benefit Registration Certificate. The Energy Benefit Registration Certificate issued during the same year that a certificate must be filed is the Certificate of Armament for Small Business. Energy Benefit Registration Certificate (EBR-01 or EBR-02) — The Department of Revenue releases the new Energy Benefit Registration Certificate (EBR-01) and the new Energy Benefit Registration Certificate (EBR-02) after it receives the application for each application. The Energy Benefit Registration Certificate (EBR-01 or EBR-02) is the new application form required for the application for the Energy Benefit Registration Certificate (EBR-01). St 13 Application Form — Download Energy Benefit Registration Certificate Application Form — minnow The new Energy Benefit Registration Certificate must be filed with the Department of Revenue. The new Energy Benefit Registration Certificate (EBR-02) must be filed if you need to add the Energy Benefit Certificate to your current energy providers. EBR-01 — Download EBR-02 — Download Energy Benefit Certificate (EBR-01) — Download The Energy Benefit Certificate (EBR-01) is electronically filed with the Department of Revenue and can be viewed using our free online Energy Certificate Viewer. Mar 29, 2025 — Renewals are issued monthly or quarterly for an Energy Benefit Registration Certificate (EBR-01) or Energy Benefit Registration Certificate (EBR-02) when the Energy Provider has updated all the applicable information on the energy records and the energy service company has paid your tax for all years of EBR-01 or EBR-02. Renewals also are issued to an energy provider who has changed the location or who is no longer providing electricity or gas to a building or property on which the Department of Revenue would like to have a certificate issued. Energy-based Energy Efficiency Program — Minnow The Minnow Energy-Based Energy Efficiency Program (EBEN) provides eligible businesses with rebates for energy used to produce equipment, machinery, building materials and buildings that reduce greenhouse gas emissions and waste.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ma DoR ST-4, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ma DoR ST-4 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ma DoR ST-4 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ma DoR ST-4 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing St 13 form ma